On January 2, 2025, the Department of the Treasury’s (“Treasury”) long-gestating outbound investment review regulations (the “Regulations”) will go into effect, following their release of a final rule. Treasury also published a new set of FAQs on December 13, 2024 to further clarify aspects of the Regulations discussed in the final rule.[1] This regime, colloquially referred to as “reverse CFIUS,” either prohibits or imposes notification requirements on certain investments by U.S. persons in three specific sectors: advanced semiconductors, quantum information technologies, and certain highly capable artificial intelligence (“AI”) systems. Such investments are prohibited or become notifiable only when they are sufficiently connected to a “country of concern,” which for now Treasury has limited to the People’s Republic of China (including Hong Kong and Macau; collectively “China”).

The Regulations largely track the Proposed Rule that Treasury released earlier this summer,[2] although Treasury has also clarified certain definitions and identified a number of excepted investments that will be exempt from the Regulations’ requirements. However, there are still several areas of ambiguity—importantly, there remains room for interpretation surrounding practical implementation of the relevant “knowledge” standard, and the actual mechanism for filing notifications is yet to be rolled out.

While the Regulations apply to a fairly limited universe of investments at present, we expect that they will still impose non-negligible diligence requirements on U.S. investors and may set the stage for more expansive Regulations on outbound investment in the future.

I. Background

The Regulations implement an Executive Order (the “E.O.”)[3] signed by President Biden in August 2023 that called for the creation of a framework to prohibit or require notifications of certain investment activity involving certain countries of concern. Specifically, the E.O. charged the Secretary of the Treasury with promulgating regulations that would: (1) require “United States persons” to provide notification of specified types of transactions involving covered foreign persons (“notifiable transactions”); and (2) prohibit U.S. persons from engaging in specified types of transactions involving covered foreign persons (“prohibited transactions”). Since that time, Treasury has released both an Advanced Notice of Proposed Rulemaking[4] and the Proposed Rule that gave a sense of the possible scope of such regulations and solicited industry feedback. The Regulations released on October 28 are mostly consistent with the signals Treasury has sent via these preliminary notices, while incorporating numerous clarifications and tweaks based on feedback from the regulated community and for consistency with efforts by other government actors in the interim. The Final Rules, and the Regulations, mark the culmination of this rulemaking process, for now, and the advent of the United States’ first outbound investment control regime. The Regulations will be published as 31 CFR Part 850.

II. Basics of the Regulations

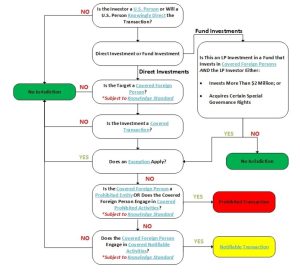

Beginning on January 2, 2025, the Regulations will: (1) prohibit certain transactions by U.S. persons involving covered foreign persons; and (2) require U.S. persons to notify Treasury of other categories of transactions involving covered foreign persons. Accordingly, investors will need to determine first whether they are part of the regulated population of investors. Assuming the investor is covered, they will next determine whether the target of the investment is a “covered foreign person,” under the Regulations and, if so, whether the business’ activities are described in the Regulations. If the answer to both is “yes,” the transaction is a “covered transaction.” The prohibition and notification requirements imposed by the Regulations apply when a U.S. person has knowledge (at the time of the transaction) that the prospective transaction undertaken by a covered investor is a covered transaction.

Is my Transaction Prohibited or Notifiable?

a. Regulated Population—Who Must Comply?

As previewed in the Proposed Rule, the outbound investment prohibition and notification requirements will apply to “U.S. persons.” This definition will include any U.S. citizen, lawful permanent resident, entity organized under the laws of the United States, including any foreign branch of any such entity, or any person in the United States.

In addition, in certain situations, the notification and prohibition requirements will extend to the activities of non-U.S. persons. Specifically, where a U.S. person controls a non-U.S. person, the U.S. person must “take all reasonable steps to prohibit and prevent any transaction by a controlled foreign entity that would be a prohibited transaction if engaged in by a U.S. person.”[5] And, U.S. persons are also prohibited from “knowingly directing a transaction by a non-U.S. person that the U.S. person knows at the time of the transaction would be a prohibited transaction if engaged in by a U.S. person.”[6] Accordingly, U.S. persons that may control non-U.S. entities (such as foreign-domiciled investment funds) should ensure that they have implemented sufficient compliance and diligence mechanisms to fulfill their obligations under this new regulatory regime.

b. “Covered Foreign Persons” and “Persons of a Country of Concern”

As highlighted above, the Regulations as currently written primarily target investments that are made in China (inclusive of Hong Kong and Macau). As such, U.S. persons engaging in investments in China should be particularly attuned to the possibility that investment targets are engaging in “covered activities” (a category described below). However, under the definitions of “covered foreign person” and “person of a country of concern,” the reach of the Regulations may in some circumstances extend to entities outside of China itself.

A “covered foreign person” is defined to include:

- a “person of a country of concern” engaged in a covered activity;

- A “person of a country of concern” is defined to include:

- An individual who is a citizen or permanent resident of China (and not a U.S. citizen or permanent resident).

- An entity that is organized under the laws of, headquartered in, incorporated in, or with a principal place of business in, China.

- The government of China (inclusive of any political subdivision, agency or instrumentality, or other subordinate entity, as well as persons acting on behalf of the Chinese government).

- Any entity that is 50% or more owned, individually or in the aggregate, by one or more of (a)-(c).

- Any entity in which one or more of (i)–(iv) holds, individually or in the aggregate, at least 50% of the outstanding voting interest, voting power of the board, or equity interest.

- A “person of a country of concern” is defined to include:

- a person that has a voting or equity interest, board seat, or contractual power to direct or cause the direction of the management or policies of a person of a country of concern where more than 50% of revenue, income, capital expenditures, and/or operating expenses relate to a person of a country of concern; and

- a person of a country of concern that participates in a joint venture[7] with a U.S. person, where the U.S. person knows at the time of entrance into the joint venture that the joint venture will engage, or plans to engage, in a covered activity.

Accordingly, even where an investment target might be organized, or operate, outside of China, U.S. investors should be cognizant that either that target’s subsidiaries (via the definition of a “covered foreign person”) or its ownership (via the definition of a “person of a country of concern”) could bring the target within the scope of these new Regulations. As discussed below with respect to the “knowledge” standard, investors should calibrate their diligence for all potentially relevant investments accordingly.

c. “Covered Transaction”

The Regulations define a “covered transaction” as the:

- Acquisition of an equity interest or contingent equity interest;

- Provision of a loan or a similar debt financing arrangement, where such debt financing affords or will afford the U.S. person an interest in profits of the covered foreign person, the right to appoint members of the board of directors (or equivalent) of the covered foreign person, or other comparable financial or governance rights characteristic of an equity investment but not typical of a loan;

- Conversion of a contingent equity interest into an equity interest, where the contingent equity interest was acquired by the U.S. person on or after January 2, 2025;

- Acquisition, leasing, or other development of operations, land, property, or other assets in a country of concern that the U.S. person knows at the time of such acquisition, leasing, or other development will result in, or that the U.S. person plans to result in:

- The establishment of a covered foreign person; or

- The engagement of a person of a country of concern in a covered activity;

- Entrance into a joint venture, wherever located, that is formed with a person of a country of concern, and that the subject U.S. person knows at the time of entrance into the joint venture that the joint venture will engage, or plans to engage, in a covered activity; or

- Acquisition of a limited partner or equivalent interest in a venture capital fund, private equity fund, fund of funds, or other pooled investment fund (in each case where the fund is not a U.S. person) that a U.S. person knows at the time of the acquisition likely will invest in a person of a country of concern that is in the semiconductors and microelectronics, quantum information technologies, or artificial intelligence sectors, and such fund undertakes a transaction that would be a covered transaction if undertaken by a U.S. person.

d. “Excepted Transactions”

Treasury clarified in the Final Rule certain investments are either categorically not “covered transactions,” or are “excepted transactions” under the Regulations. Most notably, investments made as a “limited partner” in “a venture capital fund, private equity fund, fund of funds, or other pooled investment fund,” that are either less than $2 million (aggregated across any investment and co-investment vehicles) or for which the limited partner receives “binding contractual assurance” that their capital will not be used to engage in a prohibited or notifiable transaction, are exempted from the requirements in the Regulations.

The Regulations condition most of these exceptions on the U.S. investor not receiving management or control rights that would be considered out of the ordinary for the investment (for instance, limiting the publicly traded securities exception to those where the investor’s rights are limited to “standard minority shareholder rights”). The Regulations also provide for exceptions where the transaction involves a third country that has been determined to implement similar measures (potentially paving the way for multilateral outbound investment controls), or where the investor is granted an individualized “national security exemption” by Treasury.

e. “Covered Activities”

The relevant prohibited and notifiable activities are described in general terms in Table 1, below. For the most part, these activities track the activity scopes described in the Proposed Rule. One notable difference is the Regulations’ treatment of AI systems. The Regulations combine the definitions of “artificial intelligence” and “AI system” from Executive Order 14110, “Safe, Secure, and Trustworthy Development and Use of Artificial Intelligence,”[8] indicating at least some coordination on the topic of AI across the executive branch. The Proposed Rule also had offered several possible computational thresholds at which to implement the Regulations’ notification requirement for AI systems. The Final Rule chose to impose the notification requirement on entities working with AI systems trained using a quantity of computing power greater than 10^23 computational operations—the lowest (and therefore most expansive) possible threshold identified in the Proposed Rule. While Treasury acknowledged in the Final Rule that this threshold will need to be revisited as technology advances, the selection of the more capacious threshold indicates a continuing concern with developing Chinese AI capabilities and counsels particular caution for U.S. investors entering this sector.

| Categories of Technologies and Products | Covered Prohibited Activities | Covered Notifiable Activities |

| Semiconductors and Microelectronics | Entities engaged in the development or production of any electronic design automation software for the design of integrated circuits or advanced packaging.[9]

Entities that develop or produce (1) front-end semiconductor fabrication equipment[10] designed for performing volume fabrication of integrated circuits; (2) equipment for performing volume advanced packaging; or (3) commodity, material, software, or technology designed exclusively for use in or with extreme ultraviolet lithography fabrication equipment. Entities that design integrated circuits that meet or exceed the performance parameters in Export Control Classification Number 3A090.a,[11] or integrated circuits designed for operation at or below 4.5 Kelvin. Entities that package integrated circuits using advanced packaging techniques. Entities that design, sell, or produce supercomputers enabled by advanced integrated circuits that can perform at certain thresholds. |

Entities engaged in the design, fabrication, or packaging of any integrated circuit that does not meet the parameters necessary to trigger a prohibition. |

| Quantum Information Technologies | Entities engaged in the development of quantum computers or the critical components required to produce quantum computers, such as dilution refrigerators or two-stage pulse tube cryocoolers.

Entities engaged in the development or production of quantum sensing platforms designed for, or intended to be used for, military, government intelligence, or mass-surveillance end uses. Entities engaged in the development or production of quantum networks or communication systems designed for, or intended to be used for, networking to scale up capabilities of quantum computers, secure communications, or any other application that has any military, government intelligence, or mass-surveillance end use. |

None. |

| Artificial Intelligence Systems | Entities engaged in the development of AI systems exclusively designed for, or intended to be used for, military, government intelligence, or mass surveillance end uses.

Entities engaged in AI systems trained using a quantity of computing power greater than 10^25 computational operations, or trained using primarily biological sequence data and a quantity of computing power greater than 10^24 computational operations. |

Entities engaged in the development of AI systems that are designed for military, government intelligence, or mass surveillance end uses (but not exclusively).

Entities engaged in the development of AI systems intended to be used for cybersecurity applications, digital forensics tools, penetration testing tools, or the control of robotics systems. Entities engaged in AI systems trained using a quantity of computing power greater than 10^23 computational operations. |

f. Prohibited Entities

In addition to the covered activities described above, the Regulations also prohibit covered transactions in a covered foreign person that engages in any covered activities and is:

- Included on the Bureau of Industry and Security’s (“BIS”) Entity List;[12]

- Included on the BIS Military End User List;[13]

- Meets the definition of “Military Intelligence End-User”;[14]

- Included on the Department of the Treasury’s list of Specially Designated Nationals and Blocked Persons (“SDN List”) or is owned 50% or more by an SDN;

- Included on the Department of the Treasury’s list of Non-SDN Chinese Military-Industrial Complex Companies; or

- Designated as a foreign terrorist organization by the Secretary of State.

Notably covered transactions involving such foreign persons that are captured by the above are prohibited even if the activities engaged in by the covered foreign person would only make the transaction notifiable under the Regulations.

g. Penalty for Non-Compliance

As with CFIUS and other national security and trade-related regimes, the penalties for violations track the civil and criminal penalties set forth in the International Emergency Economic Powers Act (“IEEPA”). That means that currently, violations risk (1) civil liability up to a statutory maximum of $368,136 (adjusted annually for inflation) or twice the value of the transaction, whichever is greater; or (2) criminal liability of up to $1,000,000 and imprisonment of up to 20 years per violation, if a breach is committed willfully. In addition to statutory penalties, the Regulations give Treasury the authority to nullify, void, or compel the divestment of prohibited transactions.

III. Notable Areas with Open Questions

a. “Knowledge Standard” and Diligence Requirements

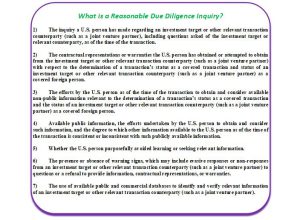

As described above, the prohibition and notification requirements are operative when the U.S. person has “knowledge” that the prospective investment is a “covered transaction.” This would mean that the U.S. person would need to have knowledge both that the target is a “covered person” and that the target engages in “covered activities.” The Regulations’ definition of “knowledge” is consistent with the definition used in other regulatory schemes[15] in that it encompasses both positive knowledge of a set of circumstances as well as “awareness of a high probability of a fact or circumstance’s existence or future occurrence,”[16] and “[r]eason to know of a fact or circumstance’s existence.”[17]

The Final Rule clarifies that, for enforcement purposes, a determination of whether a U.S. person had the requisite “knowledge” at the time of an investment will hinge on whether the person engaged in a “reasonable and diligent inquiry.” The Regulations incorporate a non-exhaustive list of considerations that Treasury will use to determine (under a “totality of the facts and circumstances” standard) whether the “reasonable and diligent inquiry” occurred.

These considerations are notably quite broad and, for the most part, do not set specific expectations for the level of diligence to be conducted by investors in advance of a given transaction. However, Treasury clearly expects relevant investors to conduct some level of pre-transaction diligence into whether the putative investment target conducts “covered activities.” We expect that, to the extent specific measures are identified by the Regulations—for instance the use of “public and commercial databases” or “contractual representations or warranties”—those specific measures set Treasury’s minimum expectations for diligence activity under this regime. We anticipate that market practice will evolve quickly in this area.

b. Notification Process

The new outbound investment regime goes into effect on January 2, 2025; however, Treasury has not yet released the actual tool that affected parties will use to file the required notifications. According to Treasury’s Guidance Document that accompanied the Final Rule,[18] notifications will be accepted via “electronic filing.” Treasury has stated that it “will post instructions on how to file … prior to the effective date of the Final Rule.”

That said, the essential details of a notification are contained in the Regulations. Notifications to the newly created Office of Global Transactions within Treasury will be required within 30 days of the completion of a notifiable transaction. Under the Final Rule, notices of covered transactions must include the following information:

- The contact information of a representative of the U.S. person filing the notification who can communicate with Treasury regarding the filing;

- A description of the U.S. person (including its place of incorporation, principal place of business, and ownership);

- Post-transaction organizational charts of the U.S. person and covered foreign person that include the name, principal place of business, and place of incorporation of the intermediate and ultimate parent entities of both parties;

- A description of the commercial rationale for the transaction;

- A description of why the U.S. person determined the transaction is notifiable;

- The status of the transaction (including actual or expected completion date);

- The total transaction value in U.S. dollars;

- The aggregate equity interest, voting interest, and board seats of the U.S. person in the covered foreign person;

- Information about the covered foreign person (including its place of incorporation, principal place of business, ownership, officers, and directors);

- Identification and description of each of the covered activity or activities undertaken by the covered foreign person that makes the transaction a covered transaction, as well as a brief description of the known end use(s) and end user(s) of the covered foreign person’s technology, products, or services; and

- Where the notice is submitted more than 30 days post-closing, a description of why the U.S. person lacked sufficient to knowledge to timely submit (including a description of any pre-transaction diligence conducted).

Following notification, Treasury may engage in a question-and-answer process (which we anticipate would look similar to the comparable process under CFIUS) and may indicate conditions with which the U.S. person investor must comply within a specified timeframe. We expect that this process, in particular, will come into increased clarity as the system develops and standard practices crystallize.

Click here to download this article.

[1] “Provisions Pertaining to U.S. Investments in Certain National Security Technologies and Products in Countries of Concern,” Department of Treasury (October 28, 2024); available at, https://home.treasury.gov/system/files/206/TreasuryDepartmentOutboundInvestmentFinalRuleWEBSITEVERSION_0.pdf; “Outbound Investment Security Program: Frequently Asked Questions,” Department of the Treasury (December 13, 2024); available at, https://home.treasury.gov/system/files/206/Outbound-Investment-Security-Program-FAQs-12-13-2024.pdf.

[2] “Provisions Pertaining to U.S. Investments in Certain National Security Technologies and Products in Countries of Concern,” Department of Treasury (July 5, 2024); available at, https://www.federalregister.gov/documents/2024/07/05/2024-13923/provisions-pertaining-to-us-investments-in-certain-national-security-technologies-and-products-in.

[3] “Executive Order on Addressing United States Investments in Certain National Security Technologies and Products in Countries of Concern,” Aug. 9, 2023; available at, https://www.whitehouse.gov/briefing-room/presidential-actions/2023/08/09/executive-order-on-addressing-united-states-investments-in-certain-national-security-technologies-and-products-in-countries-of-concern/.

[4] “Provisions Pertaining to U.S. Investments in Certain National Security Technologies and Products in Countries of Concern,” Department of Treasury (Aug. 14, 2023); available at, https://home.treasury.gov/system/files/206/Provisions%20Pertaining%20to%20U.S.%20Investments%20in%20Certain%20National%20Security%20Technologies%20and%20Products%20in%20Countries%20of%20Concern.pdf.

[5] A “controlled foreign entity” is a non-U.S. organized entity of which a U.S. person is a “parent”—i.e., general partner, managing member, investment adviser (in the case of a pooled investment fund), or owner of a 50% or greater voting interest or voting power of the entity’s board.

[6] A U.S. person “knowingly directs” a transaction when the U.S. person possesses authority to make or substantially participate in decisions made by the non-U.S. person, and exercises such authority to direct, order, or approve a transaction. Notably, the regulations include provisions identifying how a U.S. person who would otherwise have such authority can recuse themselves from specific activities.

[7] Note that, in the Final Rule, Treasury, “decline[d] to define the term ‘joint venture’… [i]nstead … refer[ring] to the plain English meaning of the term, i.e., as involving the contribution of capital and/or assets by two parties and the sharing of profits and losses. … [However], absent other facts, a ‘joint venture’ would not ordinarily result simply where there is a licensing arrangement, the sale or barter of goods and services, or resale of goods and services.”

[8] “AI system” from Executive Order 14110, “Safe, Secure, and Trustworthy Development and Use of Artificial Intelligence,” October 30, 2023; available at, https://www.federalregister.gov/documents/2023/11/01/2023-24283/safe-secure-and-trustworthy-development-and-use-of-artificial-intelligence.

[9] The term advanced packaging means to package integrated circuits in a manner that supports the two-and-one-half-dimensional (2.5D) or three-dimensional (3D) assembly of integrated circuits, such as by directly attaching one or more die or wafer using through-silicon vias, die or wafer bonding, heterogeneous integration, or other advanced methods and materials.

[10] Front-end integrated circuit fabrication equipment includes equipment used in the production stages from a blank wafer or substrate to a completed wafer or substrate. 15 CFR 744.23(a)(4), Note 1.

[11] At the time of drafting, this includes integrated circuits having one or more digital processing units having either of the following:

a.1. A “total processing performance” of 4800 or more, or

a.2. A “total processing performance” of 1600 or more and a “performance density” of 5.92 or more.

See Technical Notes 1-4 to ECCN 3A090 for descriptions of the calculation of “total processing performance” and “performance density.”

[12] Supplement No. 4 to 15 CFR part 744.

[13] Supplement No. 7 to 15 CFR part 744.

[14] 15 CFR 744.22(f)(2).

[15] See, e.g., General Prohibition 10 of the Export Administration Regulations at 15 CFR 736.2(b)(10).

[16] 31 CFR 850.216(b).

[17] 31 CFR 850.216(c).

[18] https://home.treasury.gov/news/press-releases/jy2690.